My husband and I got married when we were 21. We were both in college, had little part-time jobs, and we didn’t have a dresser. That was our first “big” purchase we needed to make. We were renting a townhouse, he had a car, my parents gave us some furniture, but we didn’t have a dresser. His savings were drained after buying me a ring and taking me on a honeymoon, but I had a little money saved up to get us going on our newlywed journey. When we started pricing out furniture, even spending $100 was a big deal to us! We decided we needed to get our finances together and see exactly how much we had and how much we could spend. That’s how tracking our finances started for us.

I’m not sure why, but my husband had Quicken on his computer. We opened it up and entered our single bank account into the software. This was one of the best financial decisions we’ve ever made! Since that day we’ve tracked every penny we spend and make. Seriously, everything. We’ve been married over 14 years and can look back and see what our monthly expenditures were back in 2004 or whenever. We can see what we saved last year vs what we saved the previous year. We can see our overall networth change, track our mortgage payments, easily find deductions when doing taxes, and more! Even more importantly, we sit down together at least monthly to look at our finances, analyze the charts, and make sure we’re on a successful financial path.

If you are not tracking your finances, I implore you to get started now! It will make a huge difference in every aspect of your finances!

Start with Tracking, Not Budgeting

I want to point out here that tracking is not the same as budgeting. Budgeting is looking at how much you make and then allotting that money to certain items i.e. $500 for groceries, $200 for gas, etc. Tracking your money is recording the details of every dollar you spend and make.

Tracking my spending has been much more beneficial to me than budgeting. While they can go hand in hand, miscellaneous expenses always seem to come up that can be hard to account for in a budget. Plus it’s almost impossible to create a budget if you don’t have a good idea of how much money you are bringing in or spending. If you are not doing so already, start tracking your money TODAY! Once you have tracked it for at least three months, you can get a good picture of what you actually spend. After you have tracked your spending for a year or multiple years, you can compare your income vs. spending, see if your grocery bill is slowly creeping up each month, figure out how much you spend on unplanned expenses, and then set in place a good and realistic budgeting method.

How to Track Your Money

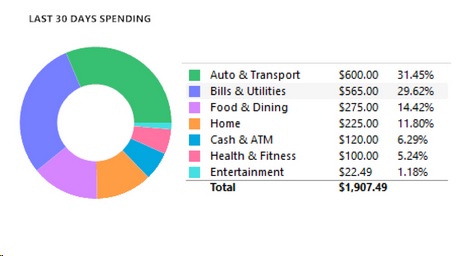

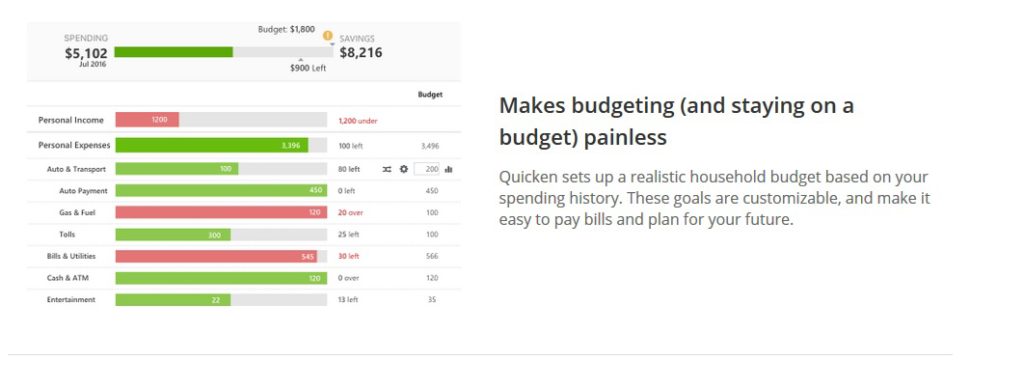

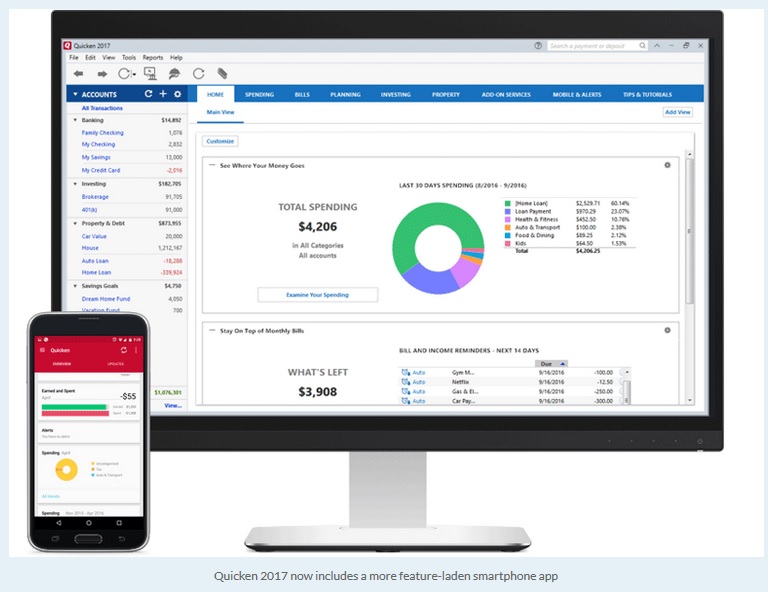

There are a lot of free Excel spreadsheets out there that you can download and get started with today. There’s this one or this one or one here. But I personally LOVE Quicken. As I mentioned earlier, I’ve been using it for a long time. Here’s a link to buy it on Amazon. You can import data right from your bank or credit card so it is easily tracked and organized. You can also set budgeting goal, pay bills, set reminders, make custom graphs or charts, and more. It’s helped me compare my spending from month to month and make decisions on if we can afford a vacation or what we should cut back on. While the free spreadsheets are a great start and definitely better than nothing, if you want to get serious about your finances, Quicken is worth the $35 price that it’s currently selling for on Amazon. Here’s a few screenshots that show how clearly Quicken can show you what your spending looks like. Plus they have a mobile app that integrates with their desktop software.

I promise you that tracking your spending will make a HUGE difference in your finances! Get started with one of the free excel spreadsheets I linked to above or by purchasing Quicken. Then set a date either weekly or monthly (no longer) that you’ll sit down at the computer and enter in every penny you spent. If you use your credit or debit card for spending then it’s easy to sign in to your bank and see the details of what you’ve spent. If you use cash, be sure to keep your receipts or carry around a notebook and write your spending down on paper so you can enter it in the computer later. After you’ve been tracking your spending for some time, sit down and take a good look at what needs to be adjusted. One month we decided we would avoid Target and Home Depot since we were making way too many trips there and spending more than we should. We wouldn’t have noticed that if we were diligent about tracking.

5 Reasons to Track Your Spending

- You need to how much money is coming in and where it is going.

- You’ll be accountable for your spending.

- You’ll be aware of questionable charges, fees, or fraudulent activity.

- It will help you set achievable goals and budgeting amounts.

- It will open your eyes to your spending habits.

Do you track your spending? If so, feel free to share your tips and what works for you!

We like to use YNAB for our budgeting needs and have been seriously budgeting for about a year and a half.

Thanks for the tip, Sara. Since we’ve been using Quicken for so long and been happy with it I haven’t researched many of the new sites or resources out there. I’ll look into YNAB and give it a try because I get questions about budgeting recommendations. Thanks!

аренда яхты в тайланде european yachts

the rest are here

Linebet Bangladesh Casino

It’s very easy to find out any topic on net as compared to textbooks, as I found this paragraph at this

site.

Here is my web site :: vpn coupon 2024

Thanks in favor of sharing such a pleasant thought,

post is good, thats why i have read it fully

Feel free to visit my site; vpn code 2024