Have you ever looked at your bank account and wondered where all your money went? Wonder why your savings account isn’t growing? You could be wasting your money! My Income Journey is all about taking control of your finances by making more money AND by saving money. You need to do both to be successful. Take a look below and make sure you aren’t wasting your money on these common money traps!

This post contains affiliate links/ads, see my disclosure for details.

1. Paying for Cable or Satellite TV

Gone are the days that cable or satellite tv subscriptions make sense. If you’re trying to save money, this should be an easy thing to drop. With Netflix, Amazon Prime TV, and Hulu all under $10/month, you can drop that ridiculous $100/month TV bill and still be plenty entertained!

2. Unplanned Grocery Shopping

If you’re going to the grocery store more than once a week, you’re wasting your money. Being a deliberate, smart shopper is one of the easiest ways to save hundreds per month! Plan your meals, make a list, check what’s on sale, and learn to use store sales combined with coupons and couponing apps to save you hundreds. I personally spend less money shopping now than I did 8 years ago even though prices are higher and my kids eat a ton more. It’s all because I’ve shifted my shopping mentality and have become an awesome shopper saving my family hundreds! I print free coupons from home from places like coupons.com (read “How to Coupon Without the Extreme“), use rebate apps like ibotta and Checkout51 (read “Top Grocery Coupon Apps“), buy a combination of store brand and name brand food depending on sales and prices, stock pile, and regularly save over 50% on my grocery receipts (see examples of my coupon brags here). You can get the same healthy food you’ve always been eating for a fraction of the price with a small amount of effort!

3. Paying for Haircuts

When I first started dating my husband he asked me to give him a haircut. I though he was crazy! I had never cut hair and had no idea what I was doing, but he had a pair of clippers and gave me some basic instructions. It actually turned out fine. I remember being really nervous when I cut his hair about a week before our wedding (what if I screw up our wedding pictures?!) but he looked good and we saved money! It’s actually quite easy to cut boys hair and little girls hair. I cut his hair about once a month and after 14 years of marriage at $10 a cut, this one thing has saved us $1,680. I also cut my kid’s hair and have saved at least $2,000 with those three kids. Buy yourself some clippers, watch a few youtube haircutting tutorials, and save your family thousands!

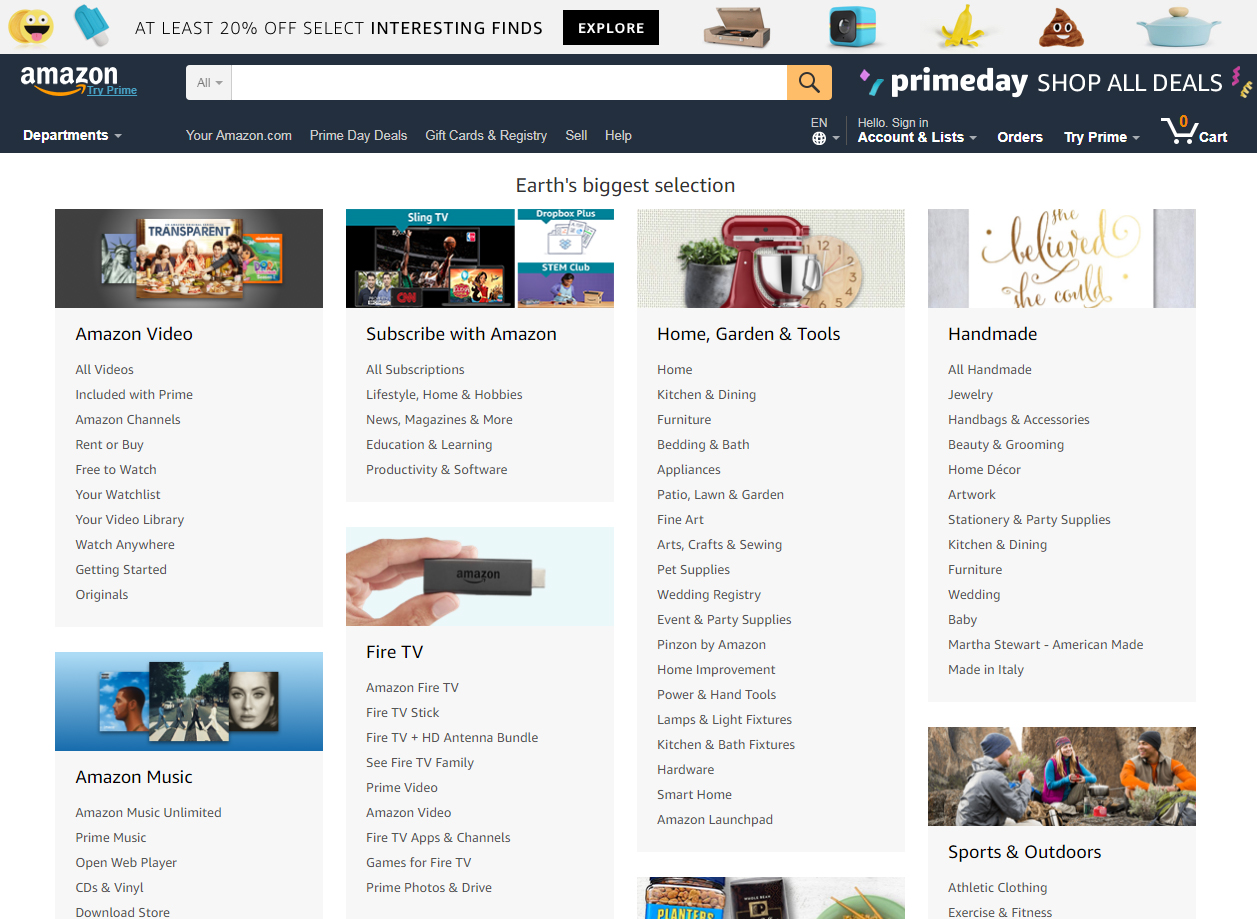

4. Not Comparison Shopping

Before you make any nonstandard purchase (games, books, TV, bike, shoes, etc.), you should be price checking. You don’t need to drive around town wasting time and gas money when apps for Amazon, Walmart, and Target make it easy to compare prices. Amazon Prime includes free shipping and Target & Walmart ship for free on orders over $35. Spend a few minutes to check at least these three stores before you buy!

5. Paying for a Home Phone

If you still use a home phone then I hope you aren’t paying more than $5 per month, total. In fact, your home phone should be FREE and those $5 should just be unavoidable taxes. Yes, you heard me correctly, your home phone should be free. That’s how I do it! You can keep your same phone number, still have caller ID and call waiting and voicemail, and more! Find out all the details of how I do it with Ooma by reading my detailed article, “How to Get FREE Home Phone Service“. Or if you want to head straight to Ooma’s site, click here.

6. Only Buying New

My family has saved thousands of dollars by shopping at garage sales, thrift stores, and online ads. If you are always buying new then you’re spending a lot more money than you need to! Garage sales are an awesome way to get many useful and good items at a fraction of the cost. My family LOVES garage sales and we typically pay around 10% for what the item would cost new. For example, $200 stroller we’d pay around $20, $100 coat we’d pay $10. Some items that are awesome garage sale buys include: bikes, kid clothes, back packs, camping equipment, candles, Christmas decorations, electronics (wires, monitors, speakers, etc.), LEGOs, toys, books, anything kid related, and more! We’ve have beautiful wood bookshelves, a lazy boy leather recliner, bins of LEGOs and wooden Thomas the Train sets, snow pants & coats, skis, candles, and more that we’ve bought around 90% off. Garage sales are the cheapest way to get items you’re looking for, but if it isn’t garage sale season then your next best bet is through craigslist or local facebook buy/sell/trade groups. Plan on bartering down the listing price a bit before you buy. Most sellers expect a lower offer than what they list the item for.

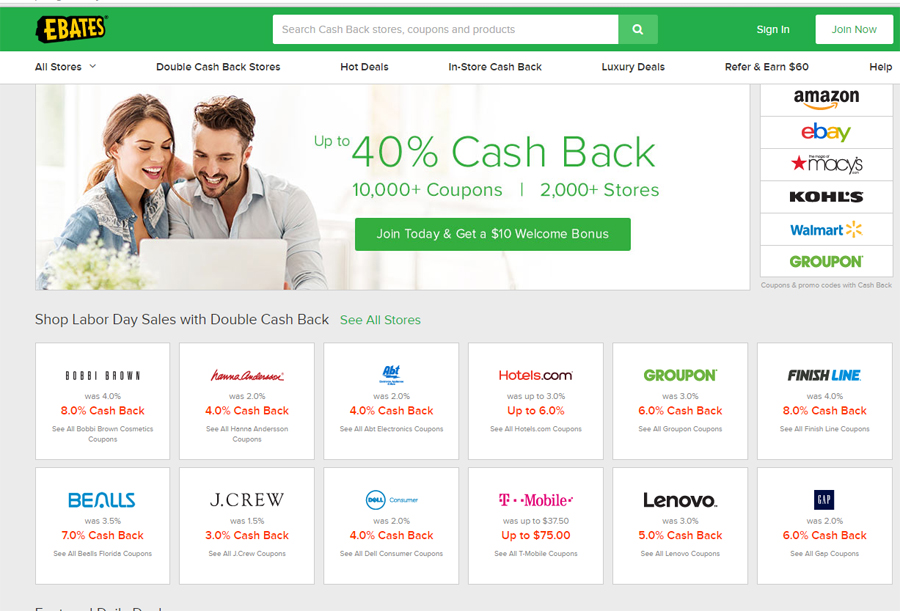

7. Not Getting Money Back When You Shop Online

After you’ve done your comparison shopping (see #4), if the best price online then you should be shopping through sites like Swagbucks or Ebates. Both sites offer you money back if you make your purchase by going to their site first and then clicking the link to the online store. For example, you want to buy something on Kohls.com (or Amazon or Walmart or wherever online). You first head to Ebates, then click “Kohls” and you’re redirected to the regular Kohls page and finish your purchase as normal. The price doesn’t change, but you’ll get 6% cash back (that’s the current Kohls offer right now, but it varies) in your Ebates account. Once you’ve earned more than $5, you’ll be sent money via Paypal or you can request a check. It’s that easy! Cash back can vary from 1% to 40%. Such an easy way to save when shopping online. Go here to sign up for Ebates or here for Swagbucks. I personally use both of them and they’re legit and simple to use.

8. Paying for Premium Fuel

Many people incorrectly believe that if they use the top grade premium fuel for their car that they’re doing their car a service or making it run better or last longer. Well, you’re not. Read your owner’s manuel and find out what type of gas your car needs, but there’s no benefit to putting in the high-grade if your car only requires mid-grade. Save yourself the $.10 – $.30 per gallon! The Federal Trade Commission says this about paying for high-octane gas, “Will higher octane gasoline clean your engine better? No, as a rule, high octane gasoline doesn’t outperform regular octane in preventing engine deposits from forming, in removing them, or in cleaning your car’s engine. In fact, the U.S. Environmental Protection Agency requires that all octane grades of all brands of gasoline contain engine cleaning detergent additives to protect against the build-up of harmful levels of engine deposits during the expected life of your car… What’s the right octane level for your car? Check your owner’s manual. Regular octane is recommended for most cars. However, some cars with high compression engines, like sports cars and certain luxury cars, need mid-grade or premium gasoline to prevent knocking.” If you’re thinking you’re doing your car a favor by paying more for high octane gas that your car doesn’t need, you’re not.

9. Wasting Leftovers

Throwing away leftovers is like throwing money down the drain. You’ve worked so hard to earn the money, buy the groceries, cook the meal, cleanup the mess, and now you’re going to throw away all that work? I don’t think so! Eat your leftovers at lunch the next day or save them and have “left overs” night for dinner. It will greatly reduce your grocery bill and save you time cooking and cleaning.

10. Paying Too Much for Airfare

One of the reasons I work from home and try so hard to be smart with our finances is so we can travel! Typically the most expensive part of traveling for us is the cost of airfare, but it doesn’t have to be that way. Before you book your flight, read my article, “7 Ways to Save Money on Flights”. It includes tips such as pretending you’re flying solo, what days of the week to fly on, and which search sites are the best. You and your family can travel for less if you take advantage of good deals and are smart in your travel purchases!

I hope these 10 tips help you realize how simple it is to cut back on your spending without having to change your lifestyle. Being smart, deliberate shopper will free up extra money each month that you can use to pay off debt, invest, or go on a vacation! No matter what your financial situation looks like right now, there’s no reason to be wasting your money!

Comments are closed.

Other than #1 I am doing good! I just love sports & a few shows lol can’t cut the cord!

I used to be a victim of unplanned grocery shopping, but I got organised and use lists and meal planning nowadays, it’s saved me a lot. But now I need to check out the cash back, I have swagbucks but never used it how sad, checking it out today. Thank you for these tips.

Great tips here! Thank you for sharing!

Great tips! Fortunately for me, I already do most of these. Yay! 🙂

These are all great! We have been doing most. I have been cutting my husband’s hair since the day I met him, and now that we have two boys, I do theirs too! We spent about $80 on a good pair of trimmers, and they have lasted almost 10 years now! I also love iBotta, and between that and the walmart savings catcher I’ve gotten almost $250 back total!!

Wow, you are on smart person! I totally loved what you had to share!!! I do a lot of things sometimes but some of them I already embrace! I love to be deliberate with my actions to save and treasure what we have!

xo Debbie | http://www.tothineownstylebetrue.com

Thanks for sharing these insightful tips! I know we’re successfully doing some of these, but not all of them.

Really thankful for all your tips because i need these ,but i must say without having any idea how much money i was wasting i was unaware.Please keep sharing such kind of money saving articles.