Welcome to My Income Journey’s money saving tips page! After you’ve worked hard to earn your money, you need to know how to wisely take care of it. Here you’ll find everything from tracking your money, how to save money when traveling, investment ideas, cutting your grocery bill, and more! There are two ways to pay for that vacation you’re dreaming of, either earn more or save more. I recommend both!

- All

- Bills & Home Savings

- Budgeting & Tracking

- Couponing

- Family & Kids

- Investing & Trading

- Money Saving Tips

How to Coupon Without the Extreme

I started couponing back in 2009. This was about a year before the extreme couponing craze took over. I did…

Best Grocery Coupon Apps!

Couponing has changed A LOT in the last 10 years and coupon apps are one of the best new additions…

10 Financial Habits Everyone Must Do

No matter what your income level or where you are in life, there are financial habits that we should all…

10 Ways You’re Wasting Your Money

Have you ever looked at your bank account and wondered where all your money went? Wonder why your savings account…

My Recommendations

Today I'm excited to share with you over 40 of my favorite tools, websites, books, etc. that have helped me…

How to Get FREE Home Phone Service!

One of the easiest money saving tips my family has implemented this year was cutting our home phone bill from…

Investing in Stocks as a Stay-at-Home Parent

This post is brought to you by Andrew from slickbucks.com. This page contains ads/affiliate links. See my full disclosure for…

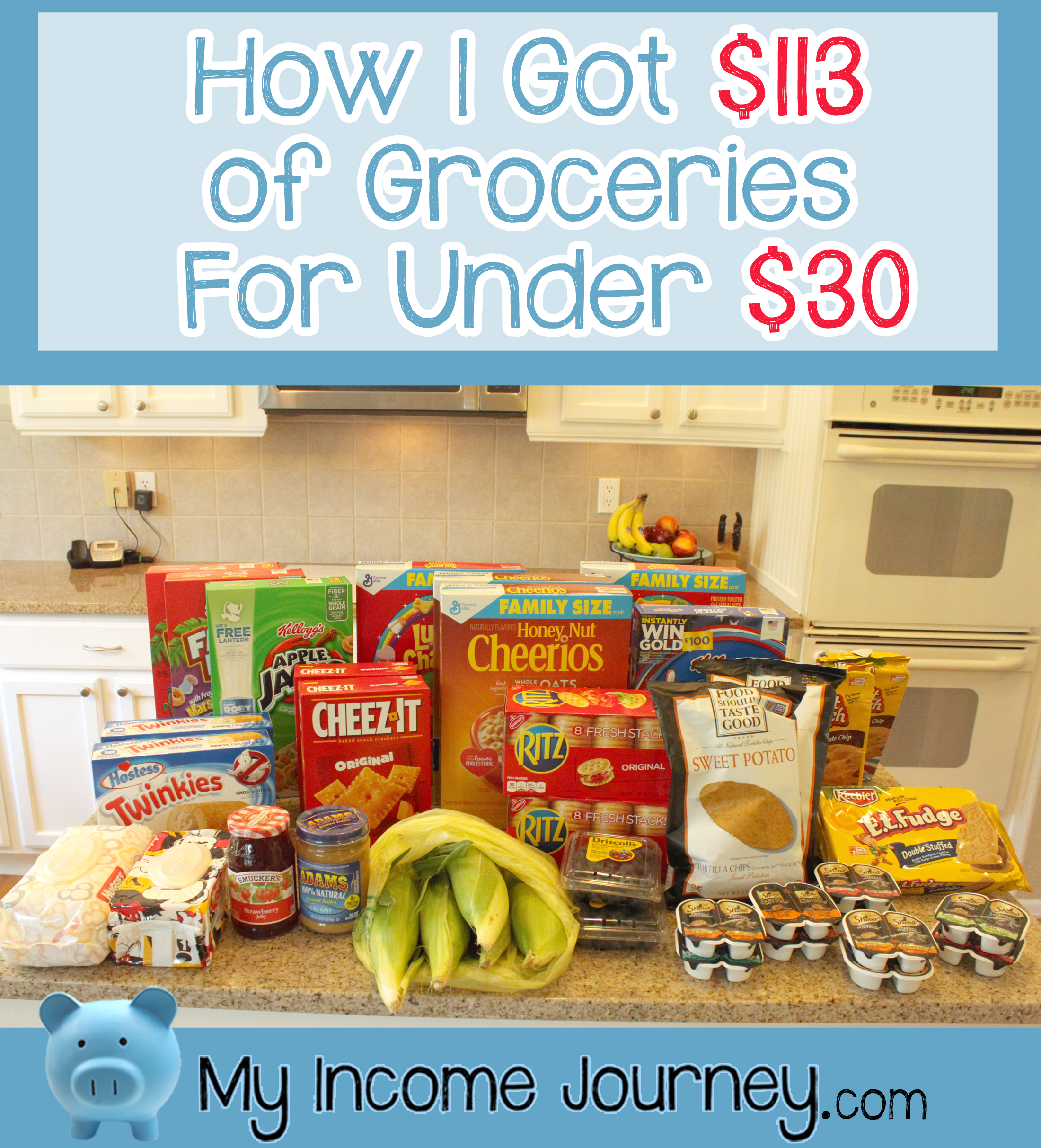

Grocery Shopping Savings Coupon Brag – April 10, 2017

Today is another Grocery Shopping Coupon Brag! I need to do them more often, but here's a look at how…

Letting Kids Make Financial Decisions – My Son and His Birthday Finances

Letting kids make financial decisions is a valuable skill that is best learned early. As parents, we work hard to…

How to Save Money on Flights – 7 Tips to Find the Cheapest Tickets

In many cases, flying can be the most expensive part of the vacation. I know as I've been planning a…

Why You Absolutely MUST Track Your Finances

My husband and I got married when we were 21. We were both in college, had little part-time jobs, and…

How Do I Get Started Working From Home?

I have a friend who's youngest child just started 1st grade this year. It's the first time in 14 years…

ibotta Review – How I Use ibotta to Save Money on Groceries

I started couponing over 10 years ago. At that time there were no smart phones or money-saving apps, but there…

Coupon Brag – January 30, 2017

It's been awhile since I've done a coupon brag, so I thought I'd show you a bit from my shopping…

Working From Home and Taxes

I hate taxes. I really hate them. Hate's a strong word, I hate them. But I hate going to jail…

How to Save Money Buying Discount Gift Cards

Did you know that you can save 5%, 10%, or even 30% from stores you regularly shop at without clipping…

How to Get Free Diapers and Baby Coupons

This guest post is brought to you by Jasmine at mysavings.com. Thanks for the great tips, Jasmine! How to Get…

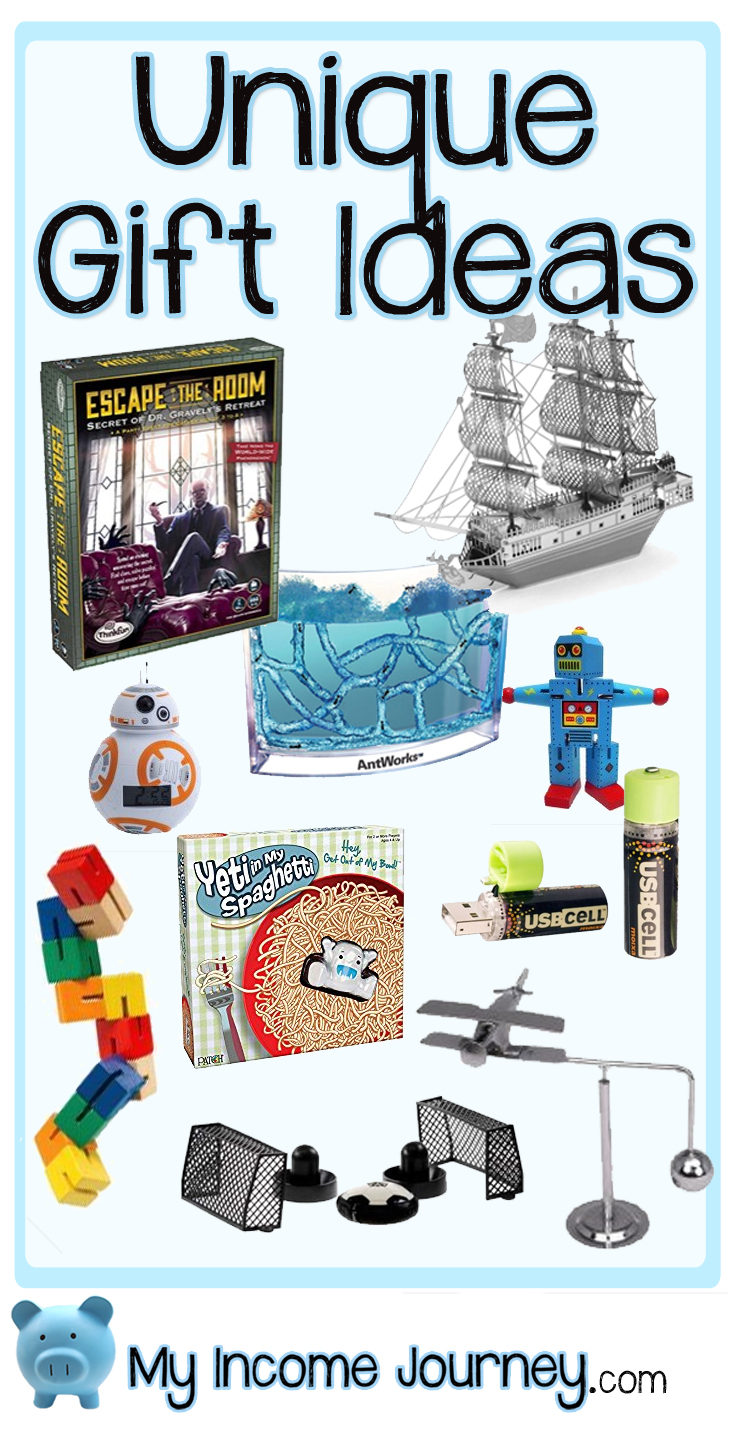

Unique Christmas Gift Ideas

I love toys that get you to think outside the box, learn something new, or stretch your imagination. My kids…

How to Budget for Christmas

There are few things in life that are more fun than giving someone you care about the perfect gift! Watching…

LEGOs On Sale

This so rarely happens that I had to let you know about it NOW! There are some awesome Amazon deals…

Smart Couples Finish Rich – Book Review

Smart Couples Finish Rich Author: David Back Year Published: 2001 Rating:

How to Easily Save $500

It is currently estimated that 62% of American households have under $1,000 in savings and 49% have zero in savings.…

9 Fun Ways to Get Free Stuff for Baby

9 Fun Ways to Get Free Stuff for Baby This post is brought to you by www.mysavings.com with their permission.…

Favorite Cheap Halloween Costumes!

Here at my house, we love Halloween! We love dressing up, trick-or-treating, corn mazes, decorating, egg nog, and Nightmare Before…

Coupon Brag – Sept. 17, 2016

Today I want to show you a bit of my shopping trip. I got over $67 worth of groceries for…

Save Money on Printer Ink

Are you still buying your ink or toner from office supply stores? It's so much cheaper to buy online! I've…

Coupon Brag – August 22, 2016

Yesterday was an alright shopping day. No huge sales going on right now, but there's always a few good deals…

Coupon Brag – August 13, 2016

I actually wasn't planning on shopping today, but we needed a few things for a camping trip so I decided…

Coupon Brag – August 8, 2016

Today was another fun day of grocery shopping! My couponing highlights includes spending $33 for $106 worth of groceries! That's…

Coupon Brag – July 30, 2016

This week was a much more productive couponing week than last week. Back to school snacks are starting to be…

Coupon Brag – July 23, 2016

Welcome to my first coupon brag on My Income Journey. I want to start coupon bragging to show you a…

Money Saving Tip – Call Your Providers

If you have never called your phone, internet, or cable provider to ask for a discount then you're paying too…

Save Money on Groceries with ibotta

This post may contain affiliate links, see my disclosure for details. Today I used ibotta for the first time and…

Save Money Shopping

How to Coupon Without the Extreme – Step by step guide to couponing

Top Coupon Apps – Earn money back after shopping

10 Ways You Are Wasting Your Money – Make sure you aren’t doing these mone-draining mistakes!

Save Money Buying Discount Gift Cards – Get discounts for places you already shop like Starbucks, Fandango, Nike, iTunes, AMC Theaters, and more!

Save Money with Ibotta – Save money with this free app and get $10 after your redeem your first rebate!

Free Stuff for Baby – How to save money and get free stuff when you have a baby.

Save Money on Bills

How to Get FREE Home Phone Service – Keep your same number, long distance, caller ID, and more for free!

Call Your Phone, Internet, and Cable Providers – How an 11-minute phone call saved me $180.

Travel Savings

How to Save Money on Plane Tickets – Seven tips to help you find the cheapest flights!

Holiday Savings

Easy, Fun, DIY Halloween Costumes – 10+ ideas that are cheaper than store bought and more fun too!

How to Budget for Christmas – Free printable to keep your spending under control.

Father’s Day Gifts Under $30 – Gift ideas for geeky, sporty, prepared, sentimental, and techie Dads.

Financial Tips

10 Financial Habits Everyone Should Be Doing – Tracking, budgeting, negotiating, credit scores, and more!

How to Start Tracking Your Finances – This is vital for financial control!

How I File Easily File Taxes – Here’s how I recommend filing taxes.

How to Easily Save $500 – Increase your savings by $500 by following this 100-day schedule.

Letting Kids Make Financial Decisions – How my son took over his birthday finances and why.